the right return rate formula – by vikram singh

I got the Right formula to reduce not only returns but also increase profits in online selling, you will be surprised after knowing the formula.

From the beginning, ever since I got my first product return, I am pondering how to calculate the cost, loss and profit of returns. You know! I’m talking about all the worse calculation parts that cause adverse effects if you didn’t calculate it on time.

We generally calculate our returns only when they tend to increase from normal %, most of the sellers don’t even know how to calculate returns, many do it wrong and the rest never take it seriously.

And wondering who ate their profits.

Well, which one you are! and if you calculate your returns timely, let me tell you something – if you still using the rate of returns formula to calculate your return%, you are still calculating returns wrong.

Curious to know how to calculate it right? -> use the Right Return Rate formula.

To understand the Right Return Rate you have to understand the Rate of Returns first.

What is the Rate of Returns?

In normal terms usually, you heard from everyone near you talking about returns, like hey bro, how are returns in your business.

Normally we name it as returns in short form. This means our sold products are being returned to us due to any reason.

From the beginning of the e-commerce industry, it is the only way through which all sellers are using to calculate returns in their business. Both traditional and online sellers are using it as a universal formula to calculate their returns.

In simple words, we can say that ” it is the calculation of the total product return after-sale in a specific period of time”

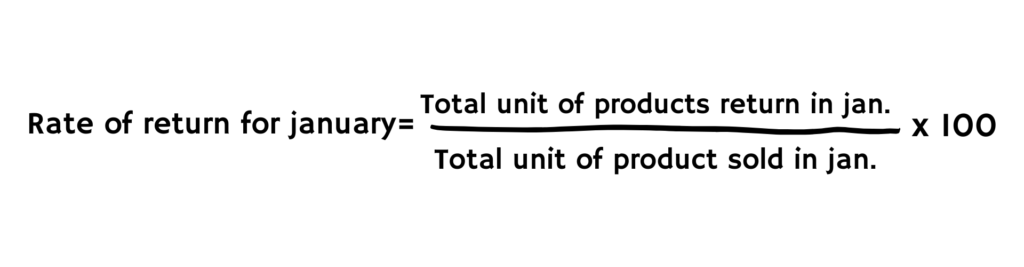

Formula to calculate Rate of Return -:

rate of returns = (units returned)/(units sold) x 100

How to calculate the Rate of Returns?

You got the formula from above and now it’s just the game of kids, many sellers do the mistake by ignoring the time period in calculating ROR.

Your first step should be to identify for how much time you’re going to find ROR 1 week, 1 month, 6 months etc. Then get the data from your dashboard or wherever you keep track of your returns.

Now, I will elaborate the formula for you – let’s suppose you have to calculate your ROR for January.

What is the Right Return Rate?

The Right Return Rate (RRR) is an advanced right method to calculate (rate of return) that help sellers to eliminate and identify hidden losses in returns.

“I Can not tell this more easily than this”, just have a little patience and read the blog ahead, Believe me, today you will learn something that will make you above millions of sellers in a moment.

After researching for a long time and tasting the pitfalls in thousands of returns, I found this new (RRR) method. I have always faced problems in calculating the returns correctly, even though I have calculated them correctly according to me, it is not as per my expectation.

We all have somehow managed to cover the hidden losses in the old rate of return, but now is the time to eliminate those profit-eating losses, I guarantee you, whoever understands RRR and use it in the right way will never face a hidden pitfall.

You know the interesting thing is I haven’t changed the ROR formula, and I can’t change even I want to. because it is perfectly created by legends of online selling already, Then why! I came up with this new RRR method thing.

WHY RRR?

⚠️Read it clearly -> " Right Return Rate is actually a right-thinking to calculate Rate of Return".⚠️

HOW does it work?

We are getting the wrong data of returns from the past many years, for example, if we observe that our 3 products are returning on every 10 products sold, we believed that our return ratio is 10:3 but is it correct? of-course not that’s why I am here. Because this is just an assumption, not the real data.

But let me clearly say that we cannot get 100% accurate return data at least not for now but the good news is that we can get almost 99% accurate data with the help of RRR.

“Without measurement, you are running on the wrong track” I always told this to my friends who ask me why we are facing low earnings. you know there is always an invisible force like gravity that always trying to pull you down, I call it returns in online selling.

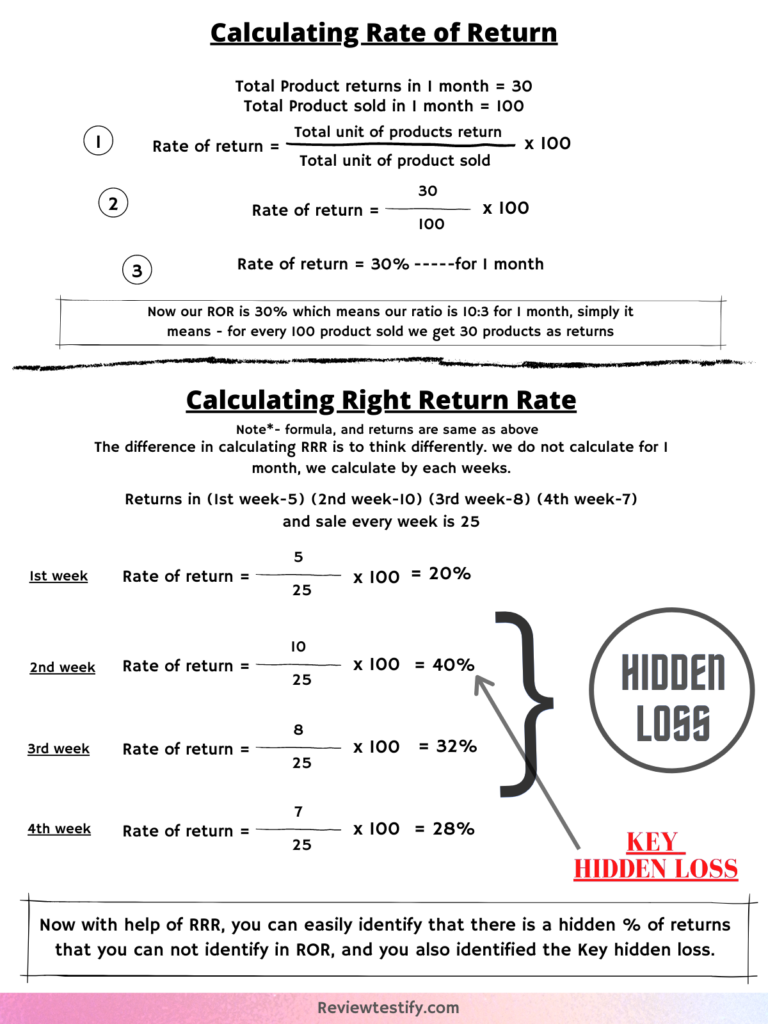

for the above stats, I describe the calculation of RRR and also how it differs from ROR. Now understand things from here, but first please observe the above image precisely.

First, look at the ROR and you can see that it shows a 30% return in a month and we found that it is not accurate. Because it doesn’t apply to us on a weekly basis, it would have been perfect! If we would had got all our returns at once in a month. But we get returns daily basis.

So here raises the question that Is ROR is the right method to calculate returns? And I’ll answer Yes! Because there is nothing wrong with the formula, it is our own fault that we are not able to use it properly but do not worry many of us have not been aware of it, even myself for years.

do you notice that in ROR we are getting data of average returns in just one month? which made it wrong on weekly basis, from here the doubts starts – is it accurate?, what if I got many returns in a week? what is my correct return ratio? etc.

I already told you above that RRR is the right mindset to calculate ROR, so in RRR we calculate returns on the weekly basis and you can see the results.

I was surprised to see that in the 2nd and 3rd-week returns% is above the average 30%, here your mind should strike that how a monthly average % can be correct if weekly returns% are above than whole month.

Now you are able to identify the hidden data let’s read ahead to learn how this data can help us from hidden losses.

Two things make RRR above ROR.

Identify Hidden Loss

Who do you think will be a more deadly enemy, one who is much stronger than you or another who is equally powerful but invisible.

Yes! You got it right, the invisible one because you can beat the stronger by pushing your own limits, but how can you defeat the one you can’t see, can’t identify his strengths and weakness.

Similarly, in computing the returns from the old ROR you are not able to identify the hidden losses, you can only look at the return ratio on a monthly average basis, and make your own assumptions for the returns in your business, And when the time came to calculate the profit, you found the poor vault.

Ok! come to the point, you see in RRR we have calculated returns on a weekly basis through which we get the data that which week is beneficial for us and which is not.

Here is the catch, now you have seen your hidden enemy and your hidden loss, you got the idea in one watch that which week is in the loss.

Yes, the 2nd week with the highest returns 40%, so how can you think that you had covered the losses of 2nd week in a month.

Now the hidden loss is identified but what you will do with it, you have seen your hidden enemy but how you will defeat him, without knowing his weakness, now let’s find its weaknesses by finding key hidden point/loss.

Identify Key Hidden Loss

Okay now you can see your enemy but he is still very powerful so how will you defeat him think🤔? Well, let me tell you. Now the only way to defeat him is to target his weak points/areas.

Similarly, after identifying the hidden loss at an overall level you have to dig deep and find the problem creating a thread.

You find that the 2nd week with 40% product return is the hidden loss, now forget about everything and keep focused to check all the key details that happen in this week.

Check that which product is returned maximum, has customer complained, have you got bad reviews, identify the leak, am sure that you will find the key problem.

Let’s suppose you find that there is a product that got bad ratings and customer is disliking it which also has affected the 3rd-week returns.

You are confused and have no idea why the customer is giving it negative ratings, even you believe that the product is really good but the only way to know now is to ask the buyer directly.

But isn’t it difficult for you! Asking each customer why they dislike the product and what’s the guarantee that everyone is available to answer your business calls.

So you decided to understand the customer thinking for that product with the help of “Reviewtestify“. And successfully got the answer that this product is not suitable for the age group you are targeting, and then, you give it another chance by targeting the relevant age group.

When RRR will work?

- 1st – Always track your returns accurately.

- 2nd – Decide a date in every month for calculating RRR, the best result is the last date of the month.

- 3rd – Divide both total units returned and total units sold on a weekly basis and apply the ROR formula on each.

- 4th – Identity hidden loss week then focus on key hidden things, find what made an increase in returns on that week.

- 5th – Solve problems to control or reduce returns if not! take the help of experts.

Now you can see the enemy, also know his weakness, then what are you waiting for now?

FAQ’s

The Right Return Rate (RRR) is an advanced right method to calculate (rate of return) that help sellers to eliminate and identify hidden losses in returns.

it is the calculation of the total percentage of returns received in our business on a specific time period. its formula is {rate of returns = (units returned)/(units sold) x 100}

In e-commerce RoR stands for the rate of returns and RRR stand for the right rate of returns, both are the formula to calculate returns in business. ROR is old and RRR is advanced.

RRR help in identifying hidden losses and key specific hidden losses and more.